Top 10 Leading Clinical Research Companies In The USA

The landscape of drug discovery and development is intricate, demanding significant resources at each stage of the process. As pharmaceutical companies strive to bring groundbreaking therapies to market, they increasingly rely on the expertise of Contract Research Organizations (CROs). These organizations play a vital role in supporting drug manufacturers throughout the entire drug development journey, from initial discovery to final approval. These CROs offer a comprehensive range of services, including clinical trial management, data research, and project management. Their critical role has become even more evident during the pandemic-induced challenges, where the need for rapid vaccine and drug development resulted in a surge of clinical trials.

The Impact of Covid-19 on Clinical Trials

At the outset of the pandemic, the clinical research landscape faced initial setbacks. However, the urgency to combat Covid-19 created an unprecedented rise in the number of clinical trials. The pressing demand for effective vaccines and treatments drove pharmaceutical companies and CROs to collaborate more than ever before. Looking ahead, the future of CROs appears promising, fueled by the rise of technologies that enable decentralized clinical trials. These modern approaches leverage digital tools and remote patient monitoring, reducing the need for physical site visits and expanding the reach of clinical research.

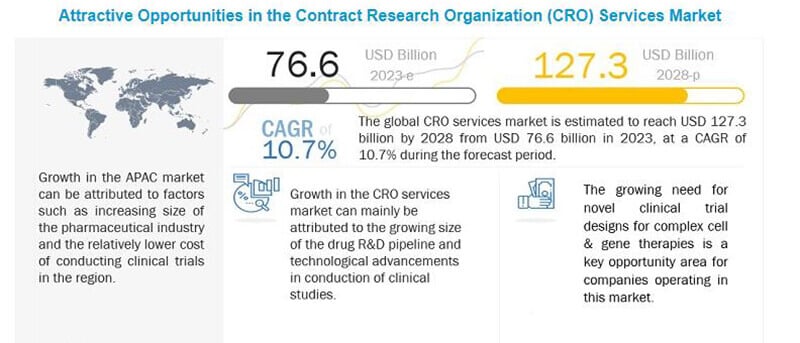

The Growth of the Global CRO Services Market

The significance of CROs is evident as the global CRO services market continues to expand exponentially. Projections indicate that this market, which was valued at US$76.6 billion, is expected to reach an impressive US$127.8 billion by 2028. This growth reflects the pivotal role CROs play in revolutionizing drug development and medical research.

Unveiling the Best 10 Clinical Research Organizations in the Field

Join us as we embark on this insightful journey, where we shine a spotlight on the ten biggest CROs shaping the pharmaceutical landscape. –

Labcorp, a leading provider of comprehensive drug development solutions for various industries, achieved a significant milestone in 2015 with its acquisition of Covance for an impressive $6 billion. This strategic union brought together Covance's expertise in drug development and Labcorp's unparalleled medical testing capabilities, propelling the company to become the world's foremost healthcare diagnostics company.

Over the past decade, Labcorp has continued to expand its influence through a series of strategic acquisitions. Notable additions to their portfolio include LipoScience, Inc., Bode Technology Group, Sequenom, MNG Laboratories, and Personal Genome Diagnostics (PGDx). These acquisitions have further strengthened Labcorp's position in the market, broadening its scope and enhancing its ability to provide cutting-edge solutions.

Looking forward to 2023, Labcorp unveiled its plans to spin off its Contract Research Organization (CRO) segment, creating a separate, independent publicly traded entity known as Fortrea.

In 2016, two industry giants, Quintiles and IMS Health, joined forces and rebranded as IQVIA, establishing the largest Contract Research Organization (CRO) globally. With a presence in over 100 countries, IQVIA brings together cutting-edge advancements in data science, technology, and human science expertise, offering clients a comprehensive end-to-end clinical and commercial service. Through a series of strategic acquisitions of smaller specialist companies, IQVIA has strengthened its position and continues to lead the way in the world of CROs.

In the year 2022, IQVIA demonstrated remarkable growth and success, generating revenues of $14.494b. This impressive growth, amounting to 3.29% on a reported basis and 7.8% at constant currency, highlighted the company's continued upward trajectory. Despite uncertain market conditions, IQVIA achieved record bookings and surpassed the goals set in their Vision 22 plan, underscoring their commitment to excellence and innovation.

Parexel continues to hold its position as one of the largest CROs globally. Specializing in Phase I to IV clinical development services, Parexel plays a vital role in expediting and ensuring the smooth progress of the drug approval process. With a comprehensive array of service offerings, the company caters to nearly every aspect of clinical trial management, supporting sponsors in conducting successful clinical studies.

In a significant development in November 2021, Parexel was acquired by EQT Private Equity and Goldman Sachs for a remarkable $8.5 billion. Despite this transition, the commitment to putting patients first remains unwavering, ensuring that Parexel maintains its patient-centric trajectory. The newly constituted board of directors brings together a wealth of experience in the life sciences industry, further strengthening Parexel's position as a leader in the field.

Pharmaceutical Product Development (PPD) stands as a leading global Contract Research Organization (CRO) with an extensive workforce of over 30,000 professionals worldwide.

The acquisition of Evidera in 2016 marked a significant milestone for PPD, solidifying their position as a leader in real-world research. Leveraging Evidera's expertise in real-world evidence, PPD has enhanced its capabilities in providing life science companies with a crucial element of the clinical development process, maintaining a competitive edge in the industry. Subsequent strategic acquisitions of Synexus (now Accelerated Enrollment Solutions) and Bioclinica, both patient recruitment and clinical research site businesses, respectively, have further augmented PPD's offerings. These collective advancements have propelled PPD's core organic growth to "high teens" in the segment, as the company achieved remarkable full-year 2022 results. With over $7.00 billion in revenue and a significant contribution of over $2.00 to adjusted earnings per share, PPD remains a dominant force in the CRO landscape, upholding their mission to facilitate groundbreaking clinical research and development.

Founded in 1999, Syneos Health has its headquarters in Morrisville, North Carolina. With an impressive annual revenue of $5,213 million and a workforce of 28,000 employees, Syneos Health is a leading international Contract Research Organization (CRO) that offers a wide range of services spanning all aspects of bringing new therapies and products to the market.

While Syneos Health provides clinical development services across all stages of drug development, it has particularly specialized expertise in assisting healthcare organizations during the late stages of clinical trials. Some of them include Early phase trials, Late phase trials, Decentralized clinical trial solutions, Clinical data management, Pharmaceutical trial services, Medical device diagnostics trial services, and more.

Operating across 46 locations worldwide, ICON is a top-tier Contract Research Organization (CRO) that provides a comprehensive range of services, including consulting, clinical development, and commercialization services.

In a pivotal move in 2016, ICON formed strategic partnerships with Genomics England for the UK's ambitious 100,000 Genomes Project and IBM Watson for oncology research support. These collaborations expanded ICON's service offerings and strengthened their presence in the fields of genomic science and oncology research, creating new opportunities for clinical research jobs in these cutting-edge sectors.

Additionally, the year 2022 marked a significant milestone for ICON, as it achieved impressive financial results. With full-year revenues amounting to US$7.7 billion, the company witnessed substantial growth of 41.2% compared to the previous year. On a constant currency basis, the revenue surge reached an outstanding 45%, reflecting ICON's continued success in advancing clinical research and serving as a leading partner for the life sciences industry.

Since its inception in 1947, this company has grown into an exceptional industry leader, specializing in cutting-edge cell and gene therapies. Not only does it provide vital lab services to the pharmaceutical, medical device, and biotech industries, but it also stands out with its impressive global presence. With a robust network spanning over 110+ facilities scatteredrobust network spanning over 110+ facilities scattered across 20+ countries, the company offers unmatched accessibility and support to clients worldwide, solidifying its reputation as a trailblazer in the field.

As of the latest data available in 2023, the company boasts an impressive annual revenue of 4.092B, a 12.73% increase year-over-year, reflecting its strong position in the market and significant contributions to the life sciences industry.

CTI Clinical Trial and Consulting Services has been making waves in the industry since its establishment in 1999. With a remarkable track record of driving over 150 new drug and medical device approvals, the company has firmly established itself as a leader in the field.

Boasting a vast international footprint, CTI operates offices in more than 60 locations across the globe, ensuring its presence and support in key regions such as North America, Europe, Latin America, Middle-East, Africa, and Asia-Pacific. In a strategic move in 2021, CTI further bolstered its position by announcing the acquisition of Dynakin, a European-based strategic consulting company. This acquisition aimed to fortify CTI's standing as a comprehensive and dynamic full-service clinical research organization, ready to take on the challenges of a rapidly evolving healthcare landscape.

MEDPACE is a global organization with a workforce of over 5,000 employees spread across 40 countries. In 2022, Medpace reported an impressive full-year revenue of $1.46 billion, reflecting a substantial 27.8% increase from the previous year. In an earnings call, Jesse Geiger, the President at Medpace, highlighted the company's ability to grow its workforce by 15.8% despite facing challenges in a competitive labor environment. In 2023, Medpace places significant emphasis on employee retention and ongoing recruitment as top priorities to support its future business endeavors.

Fisher Clinical Services is a vital division of Thermo Fisher Scientific with a rich history of over two decades in supply chain management. The company's core focus centers on efficiently handling the distribution and packaging requirements for clinical trials conducted worldwide.

With an impressive annual revenue of $20 billion and a workforce of 70,000 employees, Fisher Clinical Services is dedicated to delivering high-value products that align with the rigorous standards of pharmaceutical companies, ensuring reliability, sustainability, and optimal performance. The company plays a crucial role in supporting the success of clinical trials across the globe.

Wrap Up

In conclusion, the best Clinical Research Companies in the USA serve as indispensable partners for pharmaceutical, biotech, and medical device industries embarking on new medicine and medical device development. With the complexities of clinical trials escalating, CROs play a pivotal role in managing and leading these trials efficiently amidst rising prices, stringent regulations, and tighter deadlines.

As the pharmaceutical landscape continues to evolve, pharmaceutical companies are increasingly turning to Clinical Research Organizations for their R&D activities to maintain competitiveness, flexibility, and profitability. With their proven track record, comprehensive services, and commitment to excellence, the best Clinical Research Companies in the USA stand as crucial allies in the quest to advance medical science and improve patient outcomes. Through fruitful partnerships with CROs, the pharmaceutical, biotech, and medical device industries continue to push the boundaries of innovation and deliver life-changing products to those in need.